OTT and IPTV Platforms: Key Differences Between U.S. and EU Markets

The U.S. and EU OTT/IPTV markets differ in content delivery, regulation, and user preferences. The U.S. focuses on scalability and subscriptions, while the EU requires localized content and regulatory compliance. At More Screens, we’re adapting our solutions to meet the unique demands of each region, delivering flexible, multi-screen experiences.

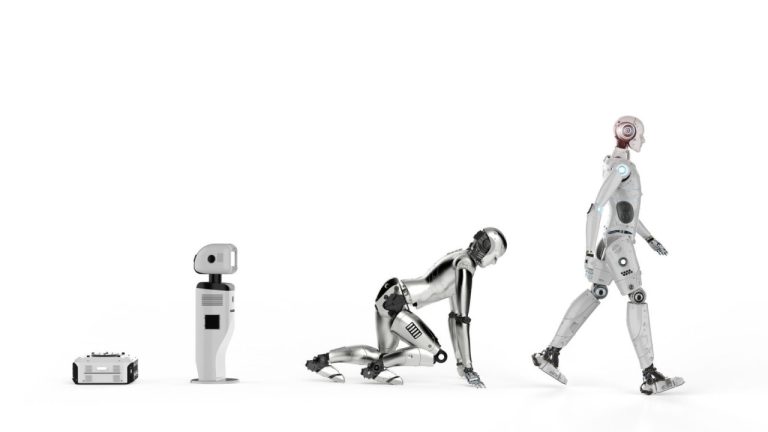

The OTT and IPTV industries in both the U.S. and the EU have evolved rapidly over the last decade, driven by advancements in technology, changing consumer behavior, and regulatory environments. While both regions are global leaders in streaming, their approaches to content delivery, platform development, and business models differ in significant ways. For companies entering these markets, especially those specializing in multi-screen video delivery solutions, understanding these nuances is critical to success.

1. Market Maturity and Consumer Expectations

The U.S. market is considered more mature in terms of OTT services, largely due to early adoption and innovation by companies like Netflix, Amazon Prime, and Hulu. American consumers have embraced a wide array of streaming options, leading to a saturated market. In contrast, the EU market, while also advanced, is more fragmented due to varying regulations, languages, and local content preferences. As a result, EU-based OTT platforms often need to cater to niche audiences or national markets, creating opportunities for more tailored, localized content delivery services.

In the U.S., consumer expectations are centered around on-demand access, content availability, and user experience, with the ability to seamlessly switch between devices—be it a smartphone, tablet, or smart TV—being a standard requirement. EU consumers share many of these expectations, but the demand for localized content and compliance with data protection laws (like GDPR) means platforms must be more region-specific in their operations.

2. Regulation and Licensing Challenges

Regulatory frameworks have a profound impact on how OTT and IPTV businesses operate in these markets. The U.S. has a relatively hands-off regulatory environment, which has enabled fast scaling for many OTT services. However, it also leads to challenges around competition, as platforms must constantly innovate to stay relevant in a crowded space.

The EU, by contrast, imposes stricter content and data regulations. For example, the Audiovisual Media Services Directive (AVMSD) requires platforms to ensure that at least 30% of their content is locally produced. This regulatory focus on cultural diversity and data privacy significantly impacts content acquisition, platform design, and user data management strategies for OTT/IPTV services. As such, U.S. players entering the EU market often face hurdles in adapting to these rules, while EU platforms tend to be more flexible when entering the U.S.

3. Content and Platform Localization

In the EU, the multilingual and multicultural nature of the market necessitates a more sophisticated approach to content localization. Platforms must account for regional languages, dubbing, and subtitling, as well as cultural preferences for content genres. For example, French, German, and Spanish audiences might have different content consumption habits compared to Scandinavian or Eastern European users. This presents both a challenge and an opportunity for developers of multi-screen solutions who can bridge these gaps with adaptive technology.

In the U.S., while platforms also need to cater to a diverse population, content is more homogenized due to the predominance of English. However, with the growing presence of Hispanic and other minority demographics, there is an increasing demand for bilingual or culturally-specific content.

For R&D companies in the video delivery space, this presents a unique challenge in terms of platform scalability and adaptability. U.S. platforms, with their emphasis on speed and scale, often require solutions that prioritize high-volume streaming with minimal latency. Meanwhile, in the EU, platforms must prioritize content personalization and adaptability across various countries, requiring more advanced metadata management and multi-language support.

4. Monetization Models

The U.S. OTT market primarily revolves around subscription-based (SVOD) and advertising-based (AVOD) models. Services like Netflix, Disney+, and HBO Max have set the standard for subscription-based streaming, while free-to-access platforms like Peacock and Pluto TV leverage AVOD to attract users with ad-supported content.

In the EU, subscription models are prevalent, but there’s a noticeable rise in hybrid models that blend subscription and advertising. Given the fragmented nature of the EU market, platforms are more likely to experiment with varied monetization strategies to meet regional demands. In regions with lower purchasing power or where traditional pay-TV still holds a significant presence, AVOD and transactional video-on-demand (TVOD) are growing in popularity.

For companies developing multi-screen video delivery solutions, this opens doors to creating adaptable platforms that can easily transition between SVOD, AVOD, and hybrid models, depending on the region and user preferences. A flexible monetization approach becomes crucial for businesses aiming to scale across both continents.

5. Infrastructure and Technology

One of the most significant distinctions between the U.S. and the EU markets is the infrastructure that underpins OTT and IPTV services. The U.S. benefits from a relatively advanced broadband network, with extensive coverage in urban and suburban areas, allowing for smooth high-definition streaming across multiple devices. In contrast, the EU has varying levels of internet infrastructure quality, with some regions, particularly in Eastern Europe, lagging behind in terms of bandwidth and connectivity.

This discrepancy in infrastructure means that while U.S. platforms can focus on delivering ultra-high-definition (UHD) and 4K content, EU platforms may need to accommodate users with slower connections. Solutions that offer adaptive bitrate streaming (ABR) and low-latency delivery across different device types will be essential for success in Europe.

For technology providers specializing in multi-screen delivery, the key lies in ensuring seamless performance across both high-end and low-bandwidth environments. Optimizing content delivery networks (CDNs) and offering solutions that can dynamically adjust to regional bandwidth limitations can provide a competitive edge in the EU market.

6. Competition and Opportunities

The U.S. market is dominated by a few large players with massive content libraries and distribution networks. As a result, there’s less room for new entrants unless they can offer a unique value proposition, such as niche content or advanced user experience features. In contrast, the EU market, with its diversity and regional differences, offers more room for smaller or regionally focused players.

For businesses like ours, that specialize in multi-screen video delivery solutions, this presents a prime opportunity to enter the U.S. market by addressing unmet needs, such as providing more flexible platform architecture, cross-device compatibility, and localized content solutions. On the other hand, in the EU, we see potential in leveraging our expertise to help platforms navigate the complex regulatory landscape, optimize content localization, and create solutions that accommodate varying internet infrastructure.

Conclusion

As the OTT and IPTV markets continue to evolve, companies must adapt to the unique challenges and opportunities presented by both the U.S. and EU markets. While the U.S. may offer a more straightforward path to scaling through established subscription and advertising models, the EU requires a more nuanced approach that balances content localization, regulatory compliance, and infrastructure challenges. Companies that can provide flexible, scalable, and adaptive video delivery solutions will be well-positioned to succeed across both continents.

For those wanting to start or OTT/IPTV business in either market, understanding these differences and tailoring strategies to regional needs is crucial for sustained growth and success, and having an experienced partner is essential.

These insights are based on More Screens’ experience navigating the OTT and IPTV sectors across both the U.S. and the EU. As we expand into new markets, we’re continuously adapting our products to meet the specific needs of each region. Whether it’s addressing the scalability demands of the U.S. or navigating the complexities of content localization and regulation in the EU, our focus remains on providing flexible, adaptive solutions tailored to the evolving requirements of multi-screen video delivery. By leveraging our expertise, we aim to help platforms deliver seamless, high-quality experiences to audiences on both sides of the Atlantic.

Related News

August 14, 2024

What Really Matters When Choosing Your OTT Technology Partner?

As we are preparing for the More Screens team to attend this year's IBC, we're sharing our CEO's latest article on how to choose the right partner for a new OTT project.

May 9, 2024

Explore your OTT opportunities: Are you ready for the new Telecommunications Services Act ?

Discover how More Screens is leading the way in compliance with Germany's new Telecommunications Services Act at ANGA 2024. Our end-to-end OTT platform empowers operators to navigate regulatory changes seamlessly while unlocking new avenues for service delivery.

January 9, 2024

Wrapping up 2023

Our CEO, Predrag Mandlbaum, looks back on the past year and gives insight into what we accomplished and what we expect for 2024.